While national team competitions drive engagement for women’s football, globally, its success isn’t solely a reflection of the World Cup audience every four years. As cited in our Women’s Football Business Report 2023, these are important yardsticks for which we can measure the trajectory of women’s football over time.

However, the biggest gains will be measured by how clubs, leagues, federations, and stakeholders work together to establish women’s football in their own markets between major events and the growth opportunities it offers to the whole game – not only the women’s product. This includes the diversity of football’s fan base and decision-makers, respectively, and how, by increasing accessibility to the game via broadcast partnerships and local clubs, women’s football can build bigger and more diverse audiences which cultivate stronger rights partnerships.

In the UK, for example, domestic fans watched more than 34 million viewing hours during the first season (2021/22) of the Women’s Super League’s (WSL) three-year partnership with pay-TV broadcaster Sky Sports and the BBC’s free-to-air (FTA) service – up from 8.83 million hours the previous season. The figures were cited in research carried out by the Women’s Football Trust (WFT), and also highlights a spike in total women’s sports viewership in the UK, which surpassed 37.6 million in 2022 (up from 32.9 million in 2021) on the back of the Lionesses’ UEFA Women’s Euro 2022 success on home soil.

“To see that major events like the Women’s Euros are not only inspiring new fans, many of whom are young and female, to watch more football, but also consume other women’s sport, is hugely exciting, and provides an interesting opportunity for brands and broadcasters to invest in women’s sport and engage with these commercially valuable audiences,” says Tammy Parlour, the WFT’s Chief Executive (CEO) and co-founder.

While a commercial opportunity, the increased appetite for domestic women’s football provides an opportunity for the game to diversify, not only its fan base, but also the women who play the game, and to encourage more women to take up coaching and administrative roles across the football ecosystem.

By way of example, having highlighted a lack of diversity within the women’s game in the build-up to the UEFA Women’s EURO 2022, the Professional Footballers’ Association (PFA) launched its See It. Achieve It campaign to address the problem of underrepresentation in the women’s game by creating a network for current WSL players from Black, mixed heritage, and minority ethnic backgrounds. We’ve also recently seen the UK Government capitalize on the Lionesses’ Women’s Euros victory on home soil by setting out new standards for equal access to sports for girls and boys in schools.

“In England, the women’s game is, undoubtedly, having a ‘moment’,” explains Marie-Christine Bouchier, the PFA’s Head of Women’s Football, who highlights the PFA’s focus on increasing the interest and participation in the women’s game as part of the union’s participation legacy. “The Lionesses’ victory in the European Championship has caught the imagination of football fans and the wider public. It has inspired more and more people to get involved – whether through playing or watching the game.”

KEY TAKEAWAYS | WOMEN’S FOOTBALL BUSINESS REPORT 2023

The latest edition of N3XT Sports’ annual Women’s Football Business Report 2023 welcomes exclusive contributions from the people leading the charge for women’s football.

They include: Jane Fernandez, Chief Operating Officer (COO) for FIFA Women’s World Cup Australia & New Zealand 2023; Sarah Gregorius, Director of Global Policy and Strategic Relations for Women’s Football at FIFPRO; Heidi Pellerano, Chief Commercial Officer (CCO) for Concacaf; Siri Wallenius, Head of International Relations at Swedish club Malmö FF; James Honeyman, Academy Manager for Arsenal Women FC; Sophie Sauvage, Head of International Women’s Football, Olympique Lyonnais Groupe; Arthur Guisasola, TikTok’s Global Sports Partner Manager; and the PFA’s Marie-Christine Bouchier.

Throughout our report, we compare the business strategies in several of the world’s burgeoning women’s football markets, including how they generate revenue as standalone products and the ways in which capital is re-invested into women’s football’s regional infrastructure. This includes the importance for developing women’s football through:

1. Commercial independence: this requires the women’s brand finding spaces where it can develop and flourish independent of its male counterparts while advocating collaboration between football’s key stakeholders and generating unique commercial opportunities for the sport.

2. Academy infrastructure: rights holders are exploring new revenue streams and investment opportunities via women’s football infrastructure, talent identification and player development, which are becoming increasingly important aspects of the women’s game and its professionalization.

3. Audience growth & retention: fan engagement grants the rights holder insights into how they should position the women’s product within their overall business objectives and how it serves the development and delivery of strategies for generating revenues via the women’s game.

4. Accessibility and demand: this includes ways in which the FIFA Women’s World Cup will inspire female participation and employment in football, as well as ways traditional, digital, and social media can boost women’s matchday attendances and drive customer relationships that appeal to sponsors.

WHAT’S N3XT?

Exposure is a term often used when we talk about the direction of women’s football. We have seen unprecedented viewership growth in the game’s major markets over the past 12 months. For example, the UEFA Women’s Euro 2022 tournament has had a positive knock-on effect for the domestic game in Europe, while the Lionesses’ victory provided significant gains for England’s WSL top-flight match attendances and broadcast viewership.

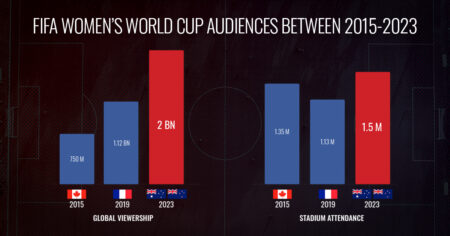

How this translates to the Australian and New Zealand markets will rely, not only on how many people tune into this year’s FIFA Women’s World Cup – the first hosted in Oceania and by two confederations – but also depends on the type of impact we will see at domestic club and grassroots level. “The FIFA Women’s World Cup will set the benchmark; with over 1.5 million people in our stadiums and more than two billion watching the tournament worldwide,” FIFA’s Fernandez explains. “The impact to the economy and the social outcome the legacy of this tournament aims to leave globally, regionally, and domestically cannot be underestimated.”

By comparison, the last edition of FIFA Women’s World Cup held in France in 2019 reached a tournament record 1.12 billion viewers worldwide, across all linear and digital channels. Meanwhile, the number of registered female players in France increased by 10 percent within eight months of the 2019 Women’s World Cup, demonstrating the influence the tournament had on the growth of the women’s game domestically, and the opportunity for clubs in particular to capitalize on interest.

In order to build a business case for women’s football, sports organizations and rights holders must first build-in their very own business strategy dedicated to the women’s product. In doing so, this is the biggest step a club, league, or federation can take when nurturing the women’s game independent of its male counterparts, while at the same time advocating an operational roadmap designed to maximize collaboration across the entire football sector.

At N3XT Sports, we work with football organizations and stakeholders to integrate business strategies that seed audience growth and commercial opportunities while increasing team and operational performance. To learn more about how our Women’s Football service can support the growth of your organization, please fill out the form below. We look forward to hearing from you.