The International Olympic Committee’s (IOC) recent decision to feature cricket at the Los Angeles 2028 (LA28) Olympic Games is perhaps the clearest indication of the sport’s growth potential. IOC President Thomas Bach welcomed cricket’s introduction onto the Olympic roster, citing the game’s “growing popularity, particularly in the T20 [short] format” as an attractive proposition.

Greg Barclay, Chair of the International Cricket Council (ICC), cricket’s global governing body, said that the Olympic Games will present a “massive shot in the arm” for the sport, having highlighted its Olympic inclusion as a “central plank of growing cricket globally”. This is outlined in the ICC’s Global Growth Strategy, published in November 2021, which highlights digital transformation as a key pillar for driving interest in both men’s and women’s competition.

The IOC’s announcement comes amid the ongoing men’s one-day international (ODI) Cricket World Cup, in India, which has seen ten national teams go head-to-head in search of the biggest prize in men’s cricket’s 50-over format (a longer version than the 20-over game coming to LA28). India is home to the Indian Premier League (IPL), one of the world’s biggest T20 franchise tournaments, and cricket’s largest domestic fan base. Meanwhile, the Indian Cricket Board (BCCI) continues to be a pioneer for the game’s increasing commercial appeal.

India’s national cricket body founded the IPL in 2008 and has been a benchmark for other domestic short-form cricket competitions, including the inception of Australia’s Big Bash League (BBL) in 2011 and English cricket’s The Hundred, launched in 2021. While fan engagement sits at the heart of the BCCI’s commercial strategy, compared to its counterparts in England and Australia, there is still however a notable difference in the way each respective cricket board leverages first-party fan data to drive engagement, as well as a huge opportunity to maximize the sport’s growth potential in its regional markets.

As part of N3XT Sports’ proprietary research into the sports industry’s digital transformation, Cricket Australia (CA) and the England and Wales Cricket Board (ECB) demonstrate the strongest data-collection capabilities of the nations competing in the India 2023 ODI Cricket World Cup and the most diverse digital portfolios. Both cricket boards engage fans via multiple digital platforms, including a dedicated website, mobile app, ecommerce platform, and a livestreaming function made available to their subscribers – underpinned by a sophisticated data-collection capability. The ECB also collects first-party ticketing data for The Hundred men’s and women’s competitions.

Whereas Australia’s and England’s cricket boards collect first-party fan data via all their digital touchpoints, consolidated by a single sign-on (SSO) function, which allows their subscribers to access every platform via a unique user login, the BCCI, among other cricketing nations, has yet to integrate a web login or data touchpoint across its owned and operated digital portfolio.

This is important since Indian cricket fans have a wealth of options to engage with the sport. In addition to the BCCI website and mobile app, which provides subscription-free highlights and other non-live video content across its competitions, the men’s IPL and the Women’s Premier League (WPL) offer similar experiences via dedicated mobile apps. As the sport prepares for LA28 in five years’ time, there appears to be, on the table, an opportunity to leverage the game’s global appeal via mobile and to seed a new, data-driven age for the modern cricket ecosystem.

CRICKET’S REGIONAL DIGITALIZATION IS PITCHING SHORTER THAN OTHER SPORTS

Aside from Australia and reigning men’s ODI Cricket World Cup champions England, there are few national cricket boards that own and operate a diverse digital portfolio, and fewer that collect first-party fan data via multiple touchpoints. For example, New Zealand Cricket (NZC) collects fan data via a digital newsletter sign-up made available via web and mobile, as well as an ecommerce registration and ticketing portal powered in collaboration with Ticketek. NZC is among 40 percent of the cricket boards assessed that own multiple digital and data touchpoints.

Each respective cricket board is assessed on its customer-facing owned and operated digital platforms, including whether they collect first-party fan data via: a web login / newsletter (1pt); an official mobile app (1pt); ecommerce (1pt); ticketing (1pt), an over-the-top (OTT) streaming subscription (2pts); and whether: the board utilizes an SSO for every data touchpoint (3pts); and/or integrates a women’s product into its data strategy (1pt).

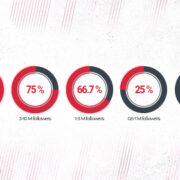

Albeit fewer national teams compete in the ODI Cricket World Cup compared to other international tournaments, 50 percent of the field at this year’s global showpiece do not collect first-party fan data compared to, for example, 25 percent of the member unions on show at the recent men’s Rugby World Cup, in France. Elsewhere, every one of the 32 member associations represented at last year’s FIFA World Cup, in Qatar, collect fan data from at least one data touchpoint.

Meanwhile, FIFA – football’s global governing body – is among the most digitally mature of the International Federations (IF) whose sports will be on display at next year’s Paris 2024 Summer Olympic Games – matched only by World Rugby, rugby union’s global governing body, for their digital-product adoption and fan-data collection. According to research published in our Olympic Digital Transformation Report 2023, 21.8 percent of the IFs featured do not collect fan data.

Notably, the ICC owns a diverse digital portfolio and collects fan data via its dedicated ICC and Cricket World Cup websites and mobile apps, the ICCTV subscription streaming service, as well as the ICC Official Store, which is run in collaboration with the US sports retailer Fanatics. Although a disparity exists between the digital and data maturity of the national cricket boards, the ICC is well positioned, digitally, to help drive engagement for the sport and its regional stakeholders.

WHAT’S N3XT?

Audience growth and customer retention are common metrics sports organizations and rights holders use to measure growth – albeit many do not yet own the digital and data maturity to establish a distinct fan funnel that appeals to commercial partners and to personalize the delivery of digital content to their individual fans. Motasem El Bawab, N3XT Sports’ Chief Information Office (CIO), outlines the key steps to aligning fan intelligence with the sports organization’s business objectives.

“One way is to implement a customer relationship management (CRM) function that makes it easy to manage the fan journey and meet each individual customer’s needs,” Mota says. “However, in order to understand your customer personally, it isn’t enough to simply integrate a new system without first leveraging the means to ingest and analyze fan data. So, it is safe to say that a certain level of data maturity or sophistication is required for a CRM function to be truly impactful.”

Our team at N3XT Sports works tirelessly to develop and implement data and digital transformation strategies across a multitude of sports properties at federation level, competition level, and club level. To find out more about how N3XT Sports can serve your organization, fill out the form below, and we’ll be in touch. Our goal is to drive the digitalization of the sports industry and our clients.