There is a wealth of options among sports organizations to digitize their operations and fan experiences. Without a clear strategy for leveraging their digital portfolio and the fan data it extracts, however, the “fan funnel” becomes inflexible, meaning that the digital-fan touchpoints organizations integrate can become a drain on the company when they have no clear objective. As a result, sports properties with a diverse direct-to-consumer (D2C) portfolio but no business strategy behind them can often suffer underwhelming returns on their investments.

Digital transformation – including the integration of D2C products connected via a centralized customer relationship management (CRM) solution or a customer data platform (CDP) – is a vital pillar for generating fan value. N3XT Sports research for our recently published 2025 Digital Trends in the Sports Industry report indicates that football clubs with both higher digital and data maturity levels throughout their front office glean stronger commercial growth compared to other properties at earlier stages of their digital transformation journey.

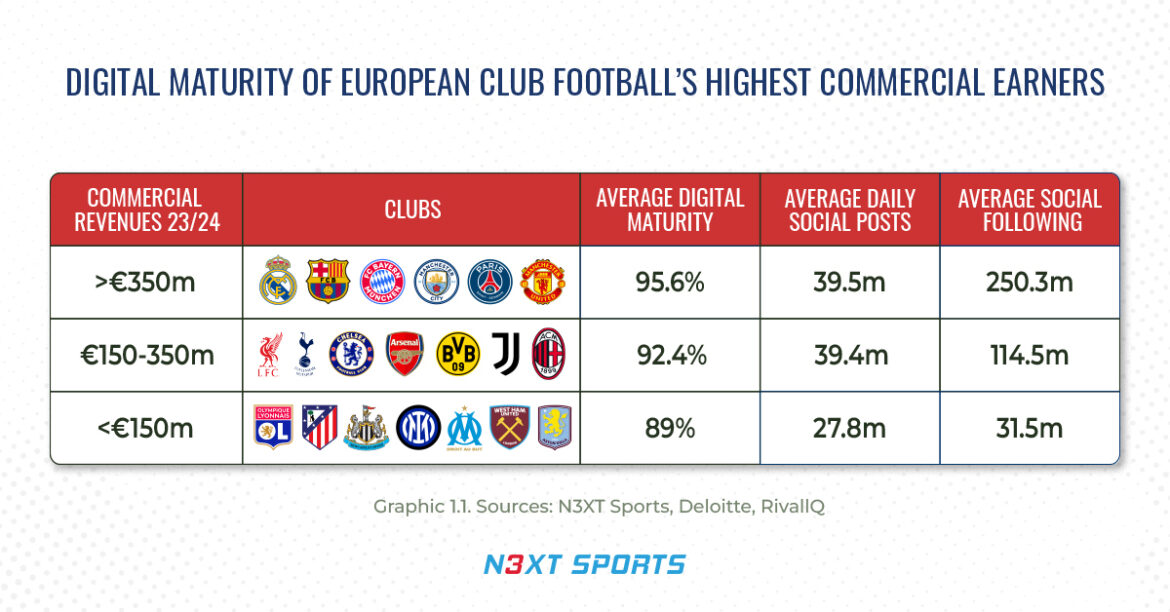

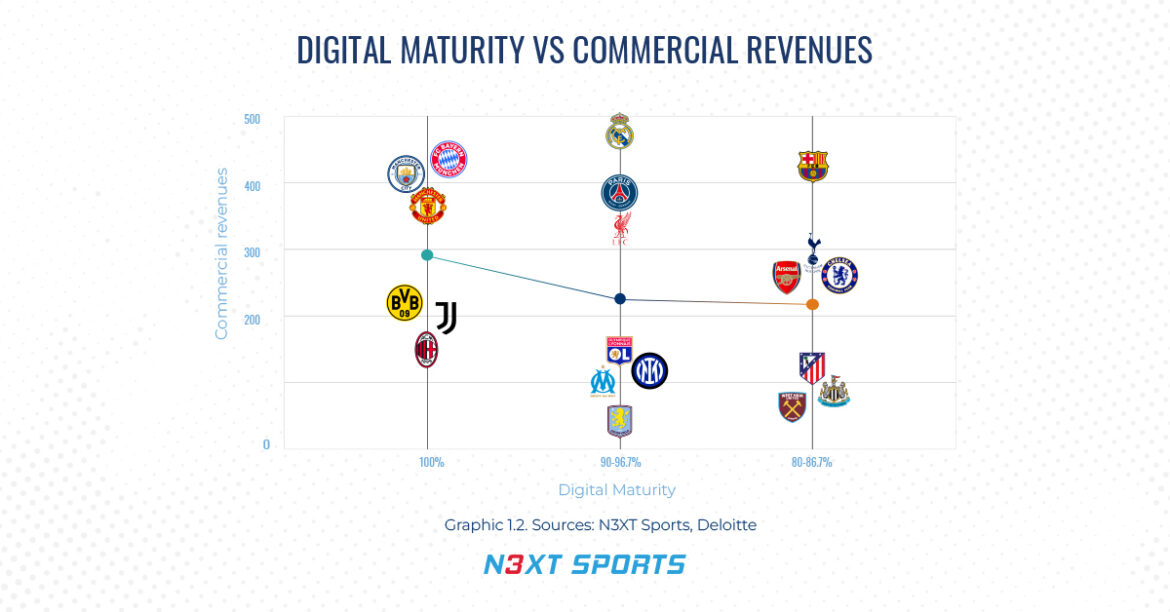

By way of example, using our unique research methodology, on average, European club football’s highest commercial earners score higher for their digital and data transformations (see graphic 1.1). Meanwhile, clubs which score a perfect 100 percent for their digital and data capabilities, according to our research, generate higher average commercial revenues, whereas those with limited digital and data maturity levels generate fewer commercial revenues (see graphic 1.2).

Although this is not indicative of every organization’s digital transformation, nor their commercial performance, it does broadly highlight the value of owning a diverse, data-enabled D2C ecosystem among European football’s most commercially viable clubs. Furthermore, it also demonstrates that, while the digital and data maturity of a sports organization contributes to its commercial growth, it cannot be achieved through digital adoption alone – but requires a clear strategy for optimizing the organization’s complete data and technological infrastructure.

Although this is not indicative of every organization’s digital transformation, nor their commercial performance, it does broadly highlight the value of owning a diverse, data-enabled D2C ecosystem among European football’s most commercially viable clubs. Furthermore, it also demonstrates that, while the digital and data maturity of a sports organization contributes to its commercial growth, it cannot be achieved through digital adoption alone – but requires a clear strategy for optimizing the organization’s complete data and technological infrastructure.

Speaking on the subject, Marcos Pelegrin, N3XT Sports’ Director of Commercial Services, says that, while Europe’s elite football clubs are “among the most digitally diverse in the sports industry”, according to N3XT Sports research, the football sector “could be working more effectively with their own data, particularly around audience acquisition and customer conversions” in international markets outside European football’s traditional strongholds.

“It’s clear from the research that the majority of elite European clubs are collecting the data, but there is a case that they could be using the data more effectively and to better serve their commercial growth and processes,” Marcos explains. “This includes how they engage with their commercial partners, the personalization of the fan experience, and to diversify their fan base in overseas markets. By putting your efforts in markets where you have fan interest or more unexplored markets your competitors aren’t looking at, you can find untapped benefits in terms of audience growth and acquisition.”

Gulf audiences are passionate about US and European sports brands

By way of example, there is an appetite among Gulf-state (GCC) audiences for consumer sporting brands and events outside the region. According to N3XT Sports research, while the region is attracting major events and tourism growth domestically, there is a significant interest in European and North American sport among audiences based in the Arabian Peninsula. For example, the Premier League – men’s English football’s top-flight – is the most-visited professional league online in Saudi Arabia, Qatar, and the United Arab Emirates (UAE).

The Saudi Pro League (SPL), through its Player Acquisition Centre of Excellence (PACE) program, is also contributing to its domestic product by attracting marquee signings from Europe’s top leagues. SPL clubs spent a record US$957 million in player signings during the 2023 transfer window and US$531 million during the 2024 window. While its global recruitment drive is establishing a domestic following online, the SPL is also attracting digital audiences outside Saudi Arabia, with the majority of the league’s web traffic (56.7 percent) coming from overseas markets.

According to research for our Digital Transformation Regional Market Report 2025 | Gulf, there is a high interest in the SPL website among users in Algeria (12.5 percent), Canada (11.8 percent), Thailand (6.7 percent), and Indonesia (3.7 percent). By comparison, Qatar’s and the United Arab Emirates’ (UAE) professional football leagues, the Qatar Stars League (QSL) and UAE Pro League, drive a 45.3 percent and 50.5 percent overseas traffic share respectively.

The SPL’s mobile distribution is much higher compared to other leagues in the region, too, with as many as 84.9 percent of its online users visiting the SPL website via mobile versus 65.5 percent for the QSL and 65.2 percent for the UAE Pro League. This highlights a significant demand for mobile-supported content among Saudi Arabia’s football fanbase during a period of record investment.

European football clubs Real Madrid (0.15 percent), Manchester United (0.18 percent), and Manchester City (0.22 percent) are each country’s most popular overseas clubs respectively, based on each country’s online audience-market share. In Qatar and the UAE, these outweigh the most popular domestic clubs in the countries assessed.

European football clubs Real Madrid (0.15 percent), Manchester United (0.18 percent), and Manchester City (0.22 percent) are each country’s most popular overseas clubs respectively, based on each country’s online audience-market share. In Qatar and the UAE, these outweigh the most popular domestic clubs in the countries assessed.

Meanwhile, the German sportswear supplier Adidas, the Austrian drinks manufacturer Red Bull, and US-based wellness technology company Whoop are among the most popular brands for web traffic in the region, according to our findings. This highlights an opportunity for the Gulf states to augment their sponsorship portfolios and to nurture a blend of commercial partnerships using hyper-personalized, mobile-supported content based on unique user insights.

Strategy-building is key to maximizing data-rich fan experiences

Diversifying a sports organization’s digital-product portfolio helps introduce new audiences into its fan funnel and provides unique monetizable touchpoints for engaging users with a commercially driven user experience (UX). While the Gulf states are investing in their digital and technological infrastructure to drive fan engagement in both domestic and international events, digitalization also holds opportunities for “investment-led growth” in other MENA nations.

For example, Morocco is investing an estimated US$4.4 billion into stadia and infrastructure projects ahead of the FIFA men’s 2030 World Cup, which the country will co-host alongside Spain and Portugal for the first time. Among the takeaways from the World Football Summit (WFS) 2025 held in Rabat, Morocco (April 9-10), African football is witnessing “surging interest in football infrastructure, clubs, and digital platforms across the continent”, offering up opportunities for global brands to connect with younger audiences in the region.

According to WFS research, a “rare alignment” between young, digital-native audiences and government support is creating “substantial growth opportunities across digital transformation, infrastructure, and commercial rights”. Omar Zerrad, N3XT Sports Digital Transformation Senior Consultant (pictured right), says that a mix of public and private investment in innovation is also presenting the region with “previously untapped avenues for creating a lasting technological legacy post-FIFA 2030” for which digital transformation is playing a “strategic role”.

“This represents a very different approach from football’s traditional nations in Europe, where digitalization is engaging an established digital fanbase,” Omar expands. “Major events such as the FIFA World Cup are, in contrast, offering an important platform to introduce new digitally driven commercial strategies and infrastructure development in the MENA region, especially among those countries still taking early strides in their own digital transformation journey.”

Our team at N3XT Sports works tirelessly to develop and implement data and digital transformation strategies across a multitude of sports properties at federation level, competition level, and club level. To find out more about how N3XT Sports can serve your organization, fill out the form below, and we’ll be in touch. Our goal is to drive the digitalization of the sports industry and our clients.